Explore the dynamics of Twitter and its influential Trend Topic (TT) feature. From defining Twitter's essence to unraveling TT strategies, this guide navigates the platform's power and impact.

- What is Twitter?

- What is to be Twitter TT?

- What is Twitter Hashtag?

- 5 Easy Steps to Increase Engagement on Twitter

- How Does the Twitter World, Twitter USA Look Like?

- Buying Twitter TT With Money

- How to Become a Twitter Member?

- Twitter TT Record, Fastest TT Record

Today, social media platforms stand out among many channels as a means of communication. Twitter, which is one of these platforms, is highly preferred by users. People from all walks of life who want to share their feelings and thoughts, especially corporate companies, news sites and famous names, can be found on this platform.

Thanks to the tweets sent, users have the opportunity to introduce themselves and their brands to large masses. Thanks to the tweets written by thousands of people on the same subject at the same time, social awareness can be created by entering the Twitter TT list on the agenda. To understand this dynamic Twitter has, let's take a closer look at "What is Twitter, What is to be Twitter TT?".

What is Twitter?

Twitter is created as a social networking site by Jack Dorsey, Noah Glass, Biz Stone, and Evan Williams. It is put into use in July 2006, shortly after its establishment on March 21, 2006. Since 2012, it has earned the title of being one of the 10 most visited websites in the world in 2013 with the blue bird logo named Larry.

It has a very strong position among social networks with 339.6 million active users in 2020. Thanks to Twitter, users can write posts on any topic within 280 characters. The average number of tweets per minute on the media is approximately 98 thousand.

What is to be Twitter TT?

Thanks to the application, it is important for users to reach the highest number of likes among thousands of tweets sent. It is requested that the posts made reach thousands of people and be talked about. Posts made for this purpose can enter the Trend Topic list.

Trend Topic (TT) is trying to list the most talked about and desired information and ideas to be announced to the masses. By using the Twitter TT list as a marketing tool, brands can reach their potential customers in the fastest way. Likewise, thanks to Twitter tts, politicians, artists and media institutions can transform themselves into a marketing strategy by having the opportunity to express themselves in the best way possible.

Each country has its own tt list on the site and a list of the most talked about topics around the world. To be tt on Twitter, the most used keywords and hashtags among the members are preferred. So, if the desired in America 'Twitter tt usa' or 'Twitter is the world's known to be entered in the world ranking.

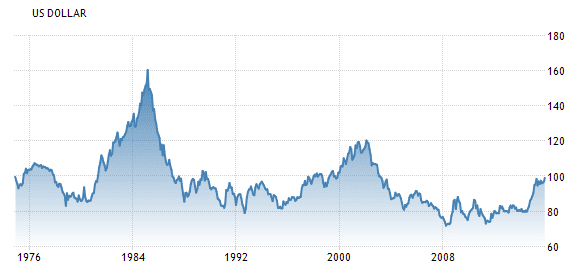

You may be interested in What is the Dollar Index, How Does It Affect Financial Markets?

What is Twitter Hashtag?

Hashtag (tag) that starts with the "#" sign serves to highlight the word or phrase that is wanted to be emphasized. Hashtags are used especially when creating the agenda in tt lists. Twitter will perceive the first word in posts as a hashtag, unless it uses hashtags.

Users get high interaction from their posts thanks to Twitter tt s. For high interaction, it is necessary to know how to look at the Twitter tt list first. When the left side of the screen shows the hashtag # Clicking on the Explore button sends most published turkey can be reached on Twitter tt list. In this way, interaction rates can be increased by sharing posts on the relevant tags.

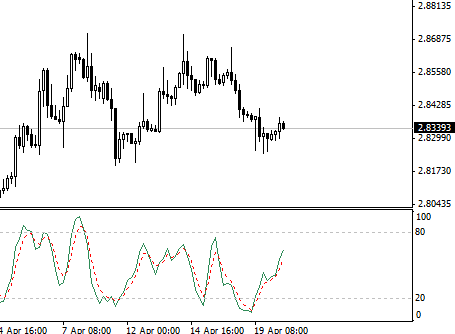

You May Be Interested What is Forex Demo Account? Top 5 Forex Broker

5 Easy Steps to Increase Engagement on Twitter

Interaction is achieved by likes, retweets, comments and link clicks on shared posts. In order to increase the interaction of posts, the following 5 easy steps can be applied to the accounts.

1-Use of Images

Images added to the tweets that are compatible with the post increase the interaction considerably. Looking at the statistics, thanks to the use of images, high interaction can be achieved such as 150% more retweets, 89% more likes and 18% more clicks than posts

2-The Power of Video

3-Hashtag Tracking

4-Retweet Feature

5-Questions and Polls

You may be interested in What are Major, Minor and Exotic Pairs?

How Does the Twitter World, Twitter USA Look Like?

When you click the # Discover button on the main page, the location settings in the upper right corner are changed and the country-based Twitter TT rank is seen. Users from abroad can follow the agenda by making calls such as Twitter tt usa from this field in the same way.

Buying Twitter TT With Money

Corporate companies and brands can stay on the agenda for hours or even days with the TT Twitter feature. In this way, it can reach the promotion of its products to large masses. However, being on the Twitter tt list is not as easy as it seems. In order to become a Twitter TT, it is necessary to publish posts by hundreds of different people with the same subject and tag.

For this reason, users buy Twitter TT with money to enter the trend topic list in a short way, and from time to time, Twitter uses the trick of tt. For this reason, users buy Twitter tt with money to enter the trend topic list shortly, and from time to time Twitter uses the trick to make tt.

Thanks to these applications, which are called Twitter tt making program or Twitter tt bot, users who buy Twitter tt can enter the top of the agenda with the tags they want. However, because there is an inorganic interaction, Twitter can capture such movements with its own algorithms. It can suspend or remove fraudulent accounts in accordance with the rules of use it regulates to maintain quality.

You may be interested in How to Trade Indices and Stocks in Forex?

How to Become a Twitter Member?

You can quickly subscribe to Twitter by going to the web site and clicking the register button. During registration, users are asked for information such as name, e-mail address, telephone. If registration via e-mail is preferred, a confirmation mail is sent to the e-mail address.

If registration is required by phone, a confirmation code is sent to the mobile phone via SMS for login. After registering the account, a user name can be set. The username must be determined from among the unique names that are not chosen by other members.

Where to Login to Twitter, How to Upload it?

You can log in to Twitter accounts via the web or mobile phones and tablets. For mobile Twitter login, Twitter application is downloaded to IOS or android phones. After the application is installed, a new membership can be created directly on mobile. If there is an existing membership, you can quickly log in via the mobile application. In this way, users can have fast and easy access wherever they are in the world.

Twitter TT Record, Fastest TT Record

On January 5, 2019, Japan's famous billionaire businessman Yusaku Maezawa becomes the holder of the Twitter TT record. Maezawa's post is the most retweeted post of all time, receiving more than 4 million retweets (RT). Maezawa, the owner of the country's largest fashion store Zozotown, is making a name for herself in the world thanks to her record tweet.

Maezawa, who announced that he will organize a lottery in his post, wants his tweet to be retweeted as a condition to participate in the lottery. It receives a rapid interaction within seconds by announcing that it will distribute 100 million new (925 thousand dollars) to 100 people among the retweets. Maezawa, who previously made a name for himself with a trip to the moon with Elon Musk's SpaceX rocket, reaches large audiences again thanks to Twitter.

If you look at Twitter's older records, the Super Bowl XL VII competition can be shown. 24.1 million tweets were made about the American football match held on February 3, 2013 to determine the National Football League NFL champion, breaking a record in this area.